Buyers, sellers, realtors, and mortgage agents have all been waiting for mortgage interest rates to drop. Here’s an update on that topic. The US and Canadian economies are tightly connected to each other and most of the time the Bank of Canada changes rates depending on how the US is performing. Until now….

Canada’s inflation rate in January was 2.9%, which is almost half a point lower than December 2023 rates. This is likely due to a drop in demand as costs of goods and services continue to rise.

So what does this mean for mortgage rates?

Canada’s economy is relatively smaller than the US, who also are the country’s biggest trade partner. Historically, this trade impacted Canada’s rates. However, currently, both countries are heading in different directions with Canada’s economy showing an upward trend in yields. Douglas Porter, Chief Economist at BMO also believes this might offer some relief for fixed mortgages. On the other hand, mortgage rates in the US have increased for three straight weeks. It currently sits at 6.9% for a 30-year amortization period, which was 6.77% last week.

However, many people aren’t sold on the interest rate cut coming in June, which is the month the Bank of Canada announces their rates. This means that the housing market will be simmering to grow over summer.

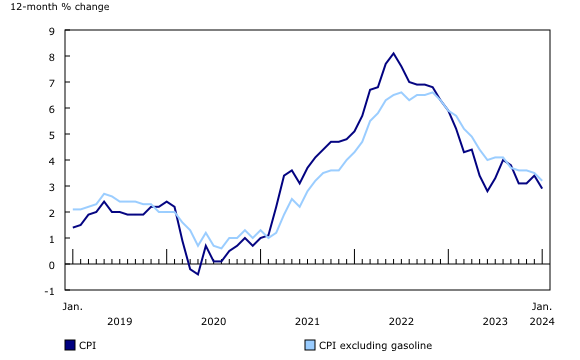

Inflation in Canada dropped faster than expected

In January 2024, Canada’s Consumer Price Index (CPI) stood at 2.9%, a significant drop from 3.4% in December 2023. Experts believed it would only drop to 3.3%, so this was unexpected since US inflation reportedly increased.

Most of this decline was brought by the gas industry. Without it, the CPI for January 2024 would be 3.2%. We also saw unusually large declines in related sectors – 23.7% drop in air fares and 3.3% in clothing.

If we took out mortgage interest rate increases from CPI, inflation rate would only be around 2%. Mortgage rates accelerated by 27.4% and rental prices grew by 7.7% (even faster than before). Neither Europe, nor the US include mortgage interest rates in their CPI calculations.

So considering all this data and the current real estate market, buying a house is a subjective choice. You may either wait till June hoping for a lower interest rate but pay more for a property or you can buy now and pay less in the long-term.

While the decision is yours, work with an experienced realtor in Brampton who understands mortgage and how inflation works, legal aspects of home ownership, and is well-aware of the local market. If you’re in the market looking for homes, reach out to Realtor Catherine Nacar. She is a multi-platinum and diamond award winner with a special interest in helping first-time home buyers find good investable opportunities.