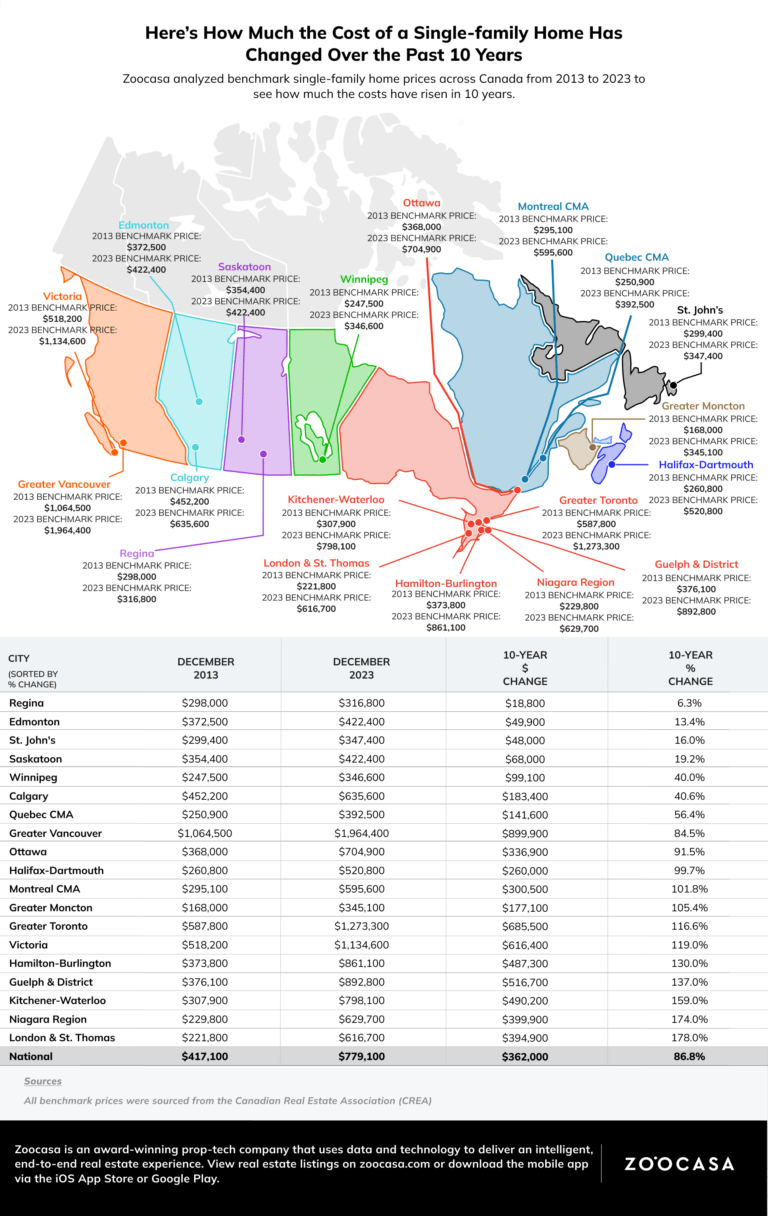

We’ve been hearing everyday in and out that the cost of living in Canada has insanely increased in the last couple years. The Greater Toronto Area (GTA) took one of the highest hits amidst this economic fluctuation post COVID-19 pandemic. According to a newly released Zoocasa report, cost of living in GTA increased by 116.6% from 2013 to 2023, during which time the price of a single family home doubled and mortgage interest rates reached its 15-year peak. The average cost of a single family home in GTA increased from $587,800 in 2013 to $1,273,300 in 2023.

Cost of Single Family Homes in Major Cities in Southern Ontario

Out of all cities in Southern Ontario, London and St Thomas saw the highest increases, where house prices grew by 178% from $221,800 in 2013 to $616,700 in 2023. Niagara Region saw a similar increase of 174% and house prices jumped from $229,800 to $629,700 in 10 years. Canada’s two major cities – Toronto and Vancouver – each saw a rise of 113% and 84.5% respectively. Other cities with remarkable increases in Southern Ontario include Hamilton and Burlington at 130% each, Kitchener and Waterloo area at 159%, and Guelph and District at 137%.

So what does this mean for first-time home buyers wanting to break into the market? This means you need to be ready for a good opportunity to strike. Many houses in the GTA are going below listing price and that trend is likely to continue until the starting of summer. During summers, prices go up every year and will likely increase this year too. If you have down payment savings, get pre-approved for a mortgage so you can lock in a low rate, and begin home hunting.

Home Prices in Other Parts of Canada

As expected, prices in the Greater Vancouver Area and Victoria saw big increases of 84.5% and 119% respectively. We’ve seen rapid price increases throughout the pandemic and even though the market has stabilized in both these cities, they haven’t declined like in GTA.

However, the Prairies did not see a rapid increase. Single-family homes in Regina just increased by 6.3% or $18,800 in the last 10 years. St. John’s and Edmonton also grew by 16% and 13.4%, which is an expected increase over 10 years. Calgary, which has been doing exceptionally well in the pre-construction market and attracting millennials, grew by 40%.

Increase in Mortgage Prices Made the Gap Even Wider

In 2023, mortgage rates were around 3.24% and were around 5% in December 2023. To put this into perspective, the monthly mortgage for a single family house in London priced at $221,800 (in 2013) would be $999. The same house now costs $3,407 in monthly mortgage payments at 5.24%, which means you are paying $2,408 extra monthly now. Both these calculations are for a 25-year amortization period with a 5-year fixed mortgage.

Looking for real estate advice for the GTA market? Realtor Catherine Nacar is here to help you. With a specialized interest in helping first-time home buyers, Catherine combines years of legal experience with local market knowledge to help you in making the right real estate investment choices. Get in touch with her today.